VIDEO

Global Taxes – Global Stagnation

***

Treasury Secretary Janet Yellen has proposed that governments around the world require payment of at least a uniform “global minimum corporate tax.” A motivation for Yellen’s push for a global minimum corporate tax is fear that the Biden administration’s proposed increase in the US corporate tax will cause some American corporations to flee the US for countries with lower corporate taxes.

President Biden wants to increase corporate taxes to help pay for his so-called infrastructure plan. The plan actually spends more on “progressive” priorities, including a down payment on the Green New Deal, than on infrastructure.

Much of the spending will benefit state-favored businesses. For example, the plan provides money to promote manufacturing and electric vehicles. So, the idea is to raise taxes on all corporations and then use some of the received tax payments to subsidize government-favored businesses and industries.

The only way to know the highest valued use of resources is by seeing what goods and services consumers voluntary choose to spend their money on. A system where the allocation of resources is based on the preferences of politicians and bureaucrats — who use force to get their way — will be less efficient than a system where consumers control the allocation of resources.

Thus, the greater role government plays in the economy the less prosperous the people will be — with the possible exception of the governing class and those who make their living currying favor with the rulers.

Yellen’s global corporate tax proposal will no doubt be supported by governments of many European Union (EU) countries, as well as the globalist bureaucrats at the Organization for Economic Cooperation and Development (OECD). For years, these governments and their power-hungry OECD allies have sought to create a global tax cartel.

The goal of those supporting global minimum taxes enforced by a global tax agency is to prevent countries from lowering their taxes. Lowering corporate and other taxes is one way countries are able to attract new businesses and grow their economies. For example, after Ireland lowered its corporate taxes, it moved from being one of the poorest countries in the EU to having one of the EU’s strongest economies. Also, American workers and investors benefited from the 2017 tax reform’s reduction of corporate taxes from 35 percent to 21 percent.

Yellen and her pro-global tax counterparts deride tax competition between countries as a “race to the bottom.” In fact, tax competition is a race to the top for the countries whose economies benefit from new investments, and for the workers and consumers who benefit from new job opportunities and new products. In contrast, a global minimum corporate tax will raise prices and lower wages, while incentivizing politicians to further increase the minimum.

A global minimum corporate tax will also set a precedent for imposition of other global minimum taxes on individuals. This scheme may even advance the old Keynesian dream of a global currency. The Biden administration is already taking steps toward a global currency by asking the International Monetary Fund to issue more special drawing rights (SDRs).

Global tax and fiat currency systems will only benefit the world’s political and financial elites. In contrast, regular people across the world benefit from limited government, free markets, sound money, and reduced or eliminated taxes.

G-7 countries agree on 15% corporate tax

Minimum seen as way to get titans to quit stashing profits by Compiled Democrat-Gazette Staff From Wire Reports | Today at 3:19 a.m.

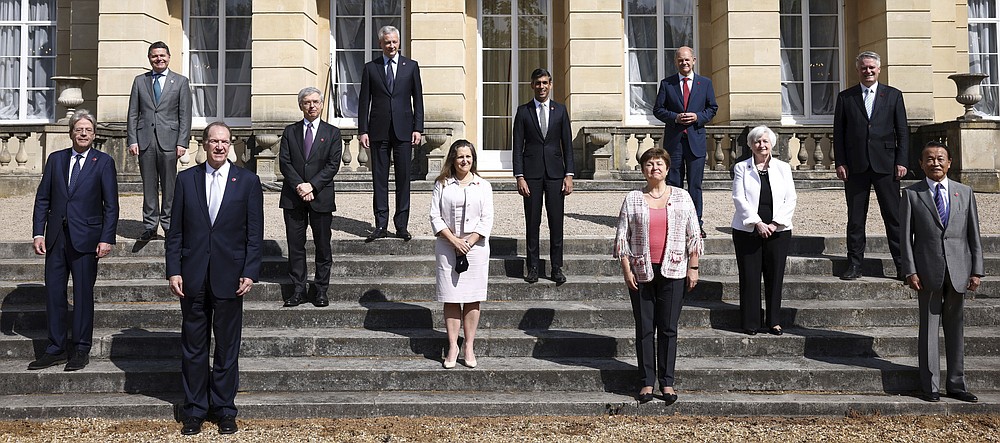

EU’s Economy Commissioner Paolo Gentiloni poses for photographs as finance ministers from across the G7 nations meet at Lancaster House in London, Saturday, June 5, 2021, ahead of the G7 leaders’ summit. (AP Photo/Alberto Pezzali, Pool)

EU’s Economy Commissioner Paolo Gentiloni poses for photographs as finance ministers from across the G7 nations meet at Lancaster House in London, Saturday, June 5, 2021, ahead of the G7 leaders’ summit. (AP Photo/Alberto Pezzali, Pool)

LONDON — The Group of Seven wealthy democracies agreed Saturday to support a global minimum corporate tax of at least 15% to deter multinational companies from avoiding taxes by stashing profits in low-rate countries.

G-7 finance ministers meeting in London also endorsed proposals to make the world’s biggest companies — including U.S.-based tech giants — pay taxes in countries where they have a lot of sales but no physical headquarters.

British Treasury chief Rishi Sunak, the host, said the deal would “reform the global tax system to make it fit for the global digital age and crucially to make sure that it’s fair, so that the right companies pay the right tax in the right places.”

U.S. Treasury Secretary Janet Yellen said the agreement “would end the race-to-the-bottom in corporate taxation and ensure fairness for the middle class and working people in the U.S. and around the world.”

“The G-7 Finance Ministers have made a significant, unprecedented commitment today that provides tremendous momentum toward achieving a robust global minimum tax at a rate of at least 15 percent,” she said in a statement.

Yellen told reporters that the agreement represented the revival of multilateral cooperation after years of strain.

Nations have long been grappling with the question of how to deter companies from legally avoiding paying taxes by using accounting and legal schemes to assign their profits to subsidiaries in tax havens — typically small countries that entice companies with low or zero taxes, even though the firms do little actual business there.

International discussions on tax issues gained momentum after President Joe Biden backed the idea of a global minimum of at least 15% on corporate profits.

The meeting of finance ministers came ahead of an annual summit of G-7 leaders scheduled for Friday through next Sunday in Cornwall, England. The endorsement from the G-7 could help build momentum for a deal in wider talks among more than 135 countries being held in Paris as well as a Group of 20 finance ministers meeting in Venice in July.

Manal Corwin, a tax principal at professional services firm KPMG and a former Treasury Department official, said the meeting had clarified where important countries stood on several key issues, including the 15% minimum.

“Signaling that there is consensus around some of the key features of what’s being discussed globally was really, really important so they have the momentum to go to the next phase of this with the G-20,” she said.

The tax proposals endorsed Saturday have two main parts. The first part lets countries tax a share of the profits earned by companies that have no physical presence but have substantial sales, for instance through selling digital advertising.

France had launched debate over the issue by imposing its own digital services tax on revenue that it deemed was earned in France by companies such as Google, Amazon and Facebook. Other countries have followed suit. The U.S. considers those national taxes to be unfair trade measures that improperly single out American firms.

Part of the agreement Saturday is that other countries would repeal their unilateral digital taxes in favor of a global agreement.

BIG STEP

Facebook’s vice president for global affairs, Nick Clegg, said the deal is a big step toward increasing business certainty and raising public confidence in the global tax system, but he acknowledged it could cost the company.

“We want the international tax reform process to succeed and recognize this could mean Facebook paying more tax, and in different places,” Clegg said on Twitter.

Many firms are willing to pay slightly more in taxes in exchange for more certainty, particularly given the lack of clarity in international tax regimes in recent years, said Daniel Bunn, an international tax expert at the Tax Foundation, a right-leaning think tank.

“Facebook has long called for reform of the global tax rules, and we welcome the important progress made at the G-7,” Clegg said. “Today’s agreement is a significant first step toward certainty for businesses and strengthening public confidence in the global tax system.”

Jose Castaneda, a Google spokesman, said: “We strongly support the work being done to update international tax rules. We hope countries continue to work together to ensure a balanced and durable agreement will be finalized soon.”

The G-7 statement echoes a U.S. proposal to let countries tax part of the earnings of the “largest and most profitable multinational enterprises — digital or not — if they are doing business within their borders. It supported awarding countries the right to tax 20% or more of local profits exceeding a 10% profit margin.

Yellen, asked if she had given her European counterparts assurances that large U.S. tech firms would be included, said the agreement “will include large profitable firms, and I believe those firms will qualify by almost any definition.”

The other main part of the proposal is for countries to tax their home companies’ overseas profits at a rate of at least 15%. That would deter the practice of using accounting schemes to shift profits to a few very-low-tax countries because earnings untaxed overseas would face a top-up tax in the headquarters country.

At home, Biden is proposing a 21% U.S. tax rate on companies’ overseas earnings, an increase from the 10.5%-13.125% enacted under former President Donald Trump. Even if the U.S. rate winds up higher than the global minimum, the difference would be small enough to eliminate most room for tax avoidance. Biden’s proposal requires congressional approval.

KPMG’s Corwin said the final statement was silent on several key points, including exactly which of the “largest and most profitable” multinationals would be covered by the proposal and how companies would be protected from double-billing if countries disagree on who has the right to tax them. Those complexities are fodder for the G-20 talks and the ongoing Organization for Economic Cooperation and Development talks in Paris.

“The devil is in the details,” Corwin said.

NOT ALL ON BOARD

International treaties require passage by a two-thirds majority in the U.S. Senate, meaning GOP votes will be necessary to ratify changes pushed by the Biden administration.

Republicans have criticized the effort, with Sen. Mike Crapo, R-Idaho, the top Republican on the Senate Finance Committee, warning that the U.S. “should not be willing to accept an agreement that continues to target American companies.”

“Republicans are unlikely to go along with this — you’re ceding tax authority and doing so in a way that disproportionately hurts U.S. companies,” said Donald Schneider, who served as chief economist to Republicans on the House Ways and Means Committee.

And it is unclear how much support the new tax floor has in parts of the European Union and other low-tax countries.

Irish finance minister Paschal Donohoe has said he has “significant reservations” about the U.S. plan and that the country would maintain its 12.5% corporate tax rate for years to come.

Donohoe said Saturday that Ireland expects to lose up to a fifth of its corporate tax revenue under the plan — amounting to more than $2.4 billion a year. The country’s relatively low tax rate is credited with helping to attract major corporations like Apple, Facebook and Google to Ireland in recent years, and Donohoe told the Irish Times that he plans to continue to “make the case for legitimate tax competition within certain boundaries.”

Any agreement that is approved by the Organization for Economic Cooperation and Development will have to take the needs of smaller countries into account, he said.

But French Finance Minister Bruno Le Maire hailed the agreement as a “historic step” in a video posted to Twitter on Saturday and has made clear in previous statements that he sees a 15% rate as the bare minimum.

Other wealthy European nations celebrated the deal, saying it would ensure that corporations fulfill their obligations and that governments receive adequate funding. Olaf Scholz, Germany’s finance minister, said the agreement was “very good news for tax justice and solidarity, and bad news for tax havens around the world.”

Spain, which is not part of the G-7, endorsed the plan Friday by signing onto a letter in The Guardian along with the finance ministers of Italy, Germany and France. The show of support from the European Union’s fourth-largest economy was viewed as a sign that the agreement could draw wider support across the bloc. Spanish newspaper El Pais has estimated that a 15% tax rate would almost double the revenue that the country receives from corporations each year.

The Group of 7 is an informal forum among Canada, France, Germany, Italy, Japan, the U.K. and the United States. European Union representatives also attend. Its decisions are not legally binding, but leaders can use the forum to exert political influence.

ONE STEP

Yellen stressed that the world needs more tax revenue from the wealthiest corporations.

“G-7 economies came together to agree the post-pandemic world must be fairer, especially with regard to international taxation,” Yellen said. “We need to have stable tax systems that raise sufficient revenue to invest in essential public goods and respond to crises, and ensure that all citizens and corporations fairly share the burden of financing government.”

Others downplayed the significance of the accord. G-7 countries all already have corporate tax rates above 15%, said Kyle Pomerleau, a tax expert at the American Enterprise Institute, a conservative-leaning think tank.

“It’s rather simple that countries that have statutory tax rates of 15% agree that other countries should also have that,” Pomerleau said. “This is step one, and from Yellen’s perspective that’s good, but it’s step one of 1,000.”

Yellen said in remarks to reporters that the agreement does not depend on voluntarily compliance by tax havens. Instead, she said it will enable countries to levy taxes on the overseas earnings of firms headquartered in those havens, putting pressure on them to raise their domestic tax rates.

“I think this is an agreement that when you understand all the details you see it does not require absolute agreement across the board,” Yellen said. “It has a way of bringing holdouts into it.”

Global tax negotiations have been ongoing at the G-7 and the Organization for Economic Cooperation and Development for the better part of a decade. But some experts said the speed with which the U.S. made major progress Saturday was striking nonetheless.

Alarm has grown among international tax experts about declining taxation. The average corporate tax rate globally was about 40% in 1980, falling to about 23% in 2020, according to the Tax Foundation. As much as $700 billion in taxes from the world’s largest multinational firms was stashed in tax havens in 2017, research by a team of economists found.

“It’s an early and quick win for Yellen and Treasury, and it’s sort of remarkable,” said Steve Rosenthal, a tax expert at the nonpartisan Tax Policy Center think tank. “This has been lingering for years and years — though of course Trump did not believe in multinationalism — and to start these negotiations in January and have a tentative agreement in June is pretty impressive.”

Others stressed the obstacles that loomed. Douglas Holtz-Eakin, a Republican former director of the Congressional Budget Office, has raised concerns about whether the U.S. will give up too much of its tax base in search of a deal with Europeans. He also stressed how many questions were left unresolved by Saturday’s statement, including the structure of the 15% minimum tax and how it would function or be approved.

“It’s easy to sit at a table and agree, ‘Yes we should have a 15 percent minimum tax.’ It’s another thing to pass through the U.S. Congress, and the U.K. parliament, and everyone else,” Holtz-Eakin said. “We can agree on the concepts — I’m sure — but will we actually have a law enforced in every country?”

Information for this article was contributed by Kelvin Chan and David McHugh of The Associated Press; and by Jeff Stein and Antonia Noori Farzan of The Washington Post.